Tax Exemption Costs Surge to Rs5.8 Trillion in FY2025 — Up 51% Despite Withdrawal Claims

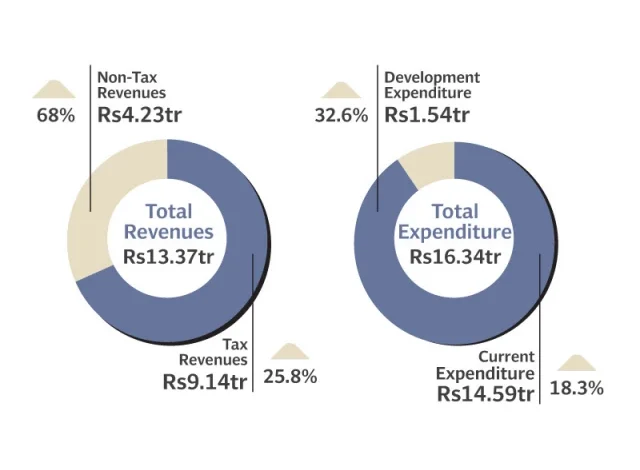

In a startling revelation, the cost of tax exemptions in Pakistan skyrocketed to Rs5.8 trillion in the current fiscal year, marking a Rs1.96 trillion increase (51%) despite the government’s claims of rolling back many tax breaks. The figure, highlighted in the Economic Survey of Pakistan 2025, now exceeds Pakistan’s external debt repayments due this year, which stand at $17 billion.

This sharp rise raises doubts about the credibility of past exemption data and suggests either hidden new exemptions or underreported previous figures. A senior FBR official admitted possible misreporting, noting some exemptions were double-counted and that losses on petroleum were mistakenly included.

Breakdown of Tax Expenditures:

Sales Tax – Rs4.3 Trillion (≈ 74% of total)

- Rs1.8T lost due to 0% tax on petroleum, offset partially by Rs78/litre levy.

- Rs683B lost on zero-rated (Fifth Schedule) items – a 232% increase.

- Rs986B under Sixth Schedule (exemptions on local/imported goods).

- Rs618B under Eighth Schedule (reduced tax rates, e.g., 5% instead of 18%).

- Rs88B on mobile phones – a 166% jump.

- Rs49B lost due to additional sales tax exemptions.

Income Tax – Rs801 Billion

- Rs 123 B exempted on govt income – up 112%.

- Rs 101 B lost through tax credits.

- Rs 444 B under the Second Schedule (income-based exemptions).

- IMF has urged the rollback of many of these breaks.

Customs Duty – Rs786 Billion

- Rs133B lost via concessions to the auto, oil, gas, and CPEC sectors.

- Rs380B lost under full exemptions (Fifth Schedule).

- Rs179B in import-related relief to exporters.

- Rs61B lost due to Free Trade Agreements.

IMF Pressure:

The IMF is demanding a rollback of all remaining exemptions, particularly in zero-rating, reduced tax brackets, and income-based exemptions. It has been asked that lower tax rates (e.g., 5%) be increased to the standard 18%, or at least doubled.

The record-high Rs5.8 trillion in lost revenue highlights the disconnect between stated fiscal reforms and actual implementation, complicating Pakistan’s efforts to expand its tax base, reduce its deficit, and meet the IMF’s conditions.

Stay tuned for more detailed breakdowns as the budget 2025–26 is formally presented.