National Assembly Passes Rs17.6 Trillion Budget with Rs463 Billion in New Taxes

ISLAMABAD:

On Thursday, the National Assembly passed the federal budget worth Rs17.6 trillion, which includes Rs463 billion in new taxes. The budget expands tax laws to cover the digital economy, although the government significantly scaled back a major enforcement provision intended to restrict financial transactions by non-compliant individuals.

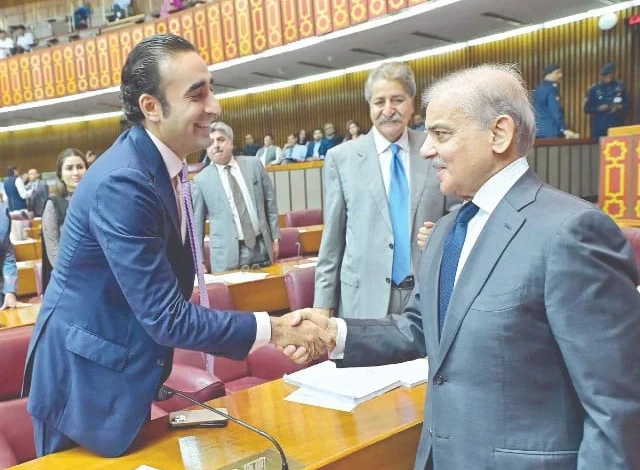

This marks the second budget presented under Prime Minister Shehbaz Sharif’s administration and was passed with ease. During a key vote, the ruling coalition secured 201 votes, while the opposition managed only 57.

It was also the second budget presented in the assembly by Finance Minister Muhammad Aurangzeb. With its approval by the National Assembly and subsequent endorsement by President Asif Ali Zardari, the Finance Act 2025 will come into force starting Tuesday.

The approved Rs17.6 trillion budget allocates the largest portion — Rs8.2 trillion — to interest payments.

Defense expenditure accounts for Rs2.55 trillion, making it the largest spending item apart from interest payments. This amount does not include funds for armed forces development or military pensions.

Subsidies are the third-highest budgetary allocation, totaling over Rs1.1 trillion, followed by Rs1 trillion each for pensions and development spending, and Rs917 billion for civil government operations.

The National Assembly also endorsed tax exemptions for several institutions, including Beaconhouse National University, Federal Ziauddin University, Punjab Police Welfare Organization, and the Army Officers Benevolent Fund and Bereaved Family Scheme.

Under the new tax framework, National Logistic Cell (NLC) contracts will be taxed at a minimum of 3% of their gross value. If NLC’s actual tax liability exceeds this, the regular 29% income tax rate will apply.

The Federal Board of Revenue (FBR) retains its power to arrest under the tax law, but with additional safeguards, as noted by Bilawal Bhutto Zardari and Deputy Prime Minister Ishaq Dar.

Speaking to The Express Tribune, the FBR chairman described the budget as the best possible under current challenges. He highlighted key reforms, including strong deterrents against tax fraud and a clear framework for sales tax registration.

To limit cash usage, the budget disallows expense claims for cash payments above Rs200,000. Similarly, input tax adjustments will be denied for cash-based purchases exceeding certain thresholds.

Foreign vendors and digital marketplaces have now been included under Pakistan’s tax laws, according to FBR officials.

A total of Rs463 billion in new taxes has been approved, including Rs36 billion in measures introduced after the original budget announcement on June 12. Major revenue-generating initiatives target e-commerce, online platforms, cash-on-delivery, and digital streaming services, with taxes applied to both sales and income.

A new Climate Support Levy of Rs2.5 per liter will be charged on petrol and diesel. Additionally, a 1% to 3% tax has been imposed on conventional fuel-powered vehicles to subsidize electric vehicles.

Pensions exceeding Rs10 million annually will now be taxed at 5%, while a new federal excise duty of Rs10 per one-day-old chick has also been introduced.

Initially, the government projected revenue of Rs389 billion through a stringent measure banning financial transactions by non-filers. Finance Minister Aurangzeb had earlier warned that, without this provision, a Rs500 billion mini-budget would be needed.

However, on the Prime Minister’s instructions, these powers were softened.

The approved version of the law states that non-filers may only be barred from buying residential property if its value exceeds Rs50 million, and commercial property if over Rs100 million. They may still purchase vehicles valued up to Rs7 million.